For AR/VR 2.0 to live, AR/VR 1.0 must die

The future of AR/VR could be bright, but only if it moves beyond where it is today. 2018 was the first of what look like two transitional years, with a potential shakeout in 2019 before an inflection point in late 2020. Let’s look at where we are today, where we’re heading tomorrow and some of the changes needed to get us there. (Note: There were earlier generations of AR/VR, but this discussion focuses on the post-2014 market.)

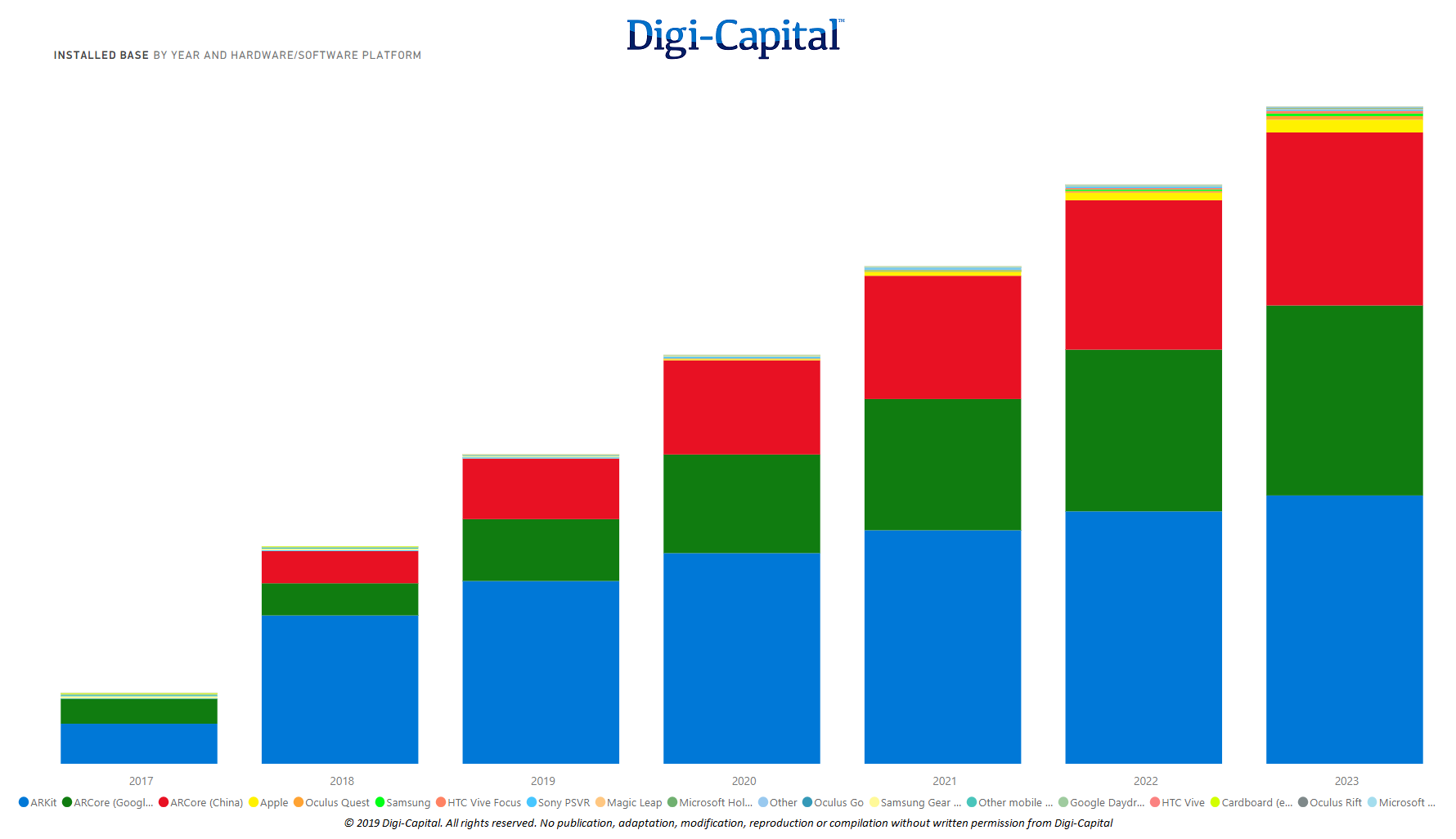

AR/VR Installed Base (including mobile AR)

Source: Digi-Capital AR/VR Analytics Platform

AR/VR 1.0 — where are we now?

AR/VR 1.0 kicked off in earnest when Facebook bought Oculus back in 2014. This inspired a generation of entrepreneurs, corporates and VCs to build early-stage AR/VR. Despite significant technical progress, even industry insiders admit this hasn’t produced a mass market yet.

Mobile AR delivered 2 percent higher revenue than we forecast for 2018 at over $3 billion globally, driven by app store revenues (primarily Pokémon GO), ad spend (e.g. from mobile AR features in messaging apps) and e-commerce sales (e.g. Houzz delivering 11x sales uplift). Mobile AR installed base (i.e. configured devices) grew more slowly than anticipated, to more than 850 million globally (note: this isn’t active users, which is a much lower number). As anticipated, there weren’t any standalone breakout mobile AR apps last year. Developers are still figuring out what does and doesn’t work for mobile AR.

Smartglasses had a mixed 2018, with Microsoft HoloLens winning a $480 million U.S. military contract, Magic Leap launching more of a dev kit than a consumer product and other early smartglasses pioneers reported to be selling assets or furloughing staff. Smartglasses revenue (mainly hardware and enterprise solutions/services) was in the hundreds of millions of dollars, which together with mobile AR delivered total AR market revenue 3 percent lower than anticipated. So as in the last three years, AR revenue was broadly in line with Digi-Capital forecasts.

For VR, at the start of last year we didn’t anticipate phone makers largely abandoning mobile phone pre-order headset bundles (negatively impacting mobile VR sales/installed base significantly), and got timing wrong for Oculus Quest launching in holiday 2018 (announced late last year as Spring 2019). The mid-year launch of Oculus Go and our accurate forecast of Sony PSVR sales helped, but together with attrition rates, the VR market was down year-on-year for 2018 in terms of unit sales, installed bases and revenue at less than $3 billion (rather than the modest growth we forecast).

AR/VR 2.0 — where are we going?

AR (mobile AR, smartglasses) could top two and a half billion installed base and $70 billion to $75 billion revenue by 2023. VR (mobile, standalone, console, PC) might deliver more than 30 million installed base and $10 billion to $15 billion revenue in the same time frame. That’s a pretty big difference, so let’s dig into the data to understand why.

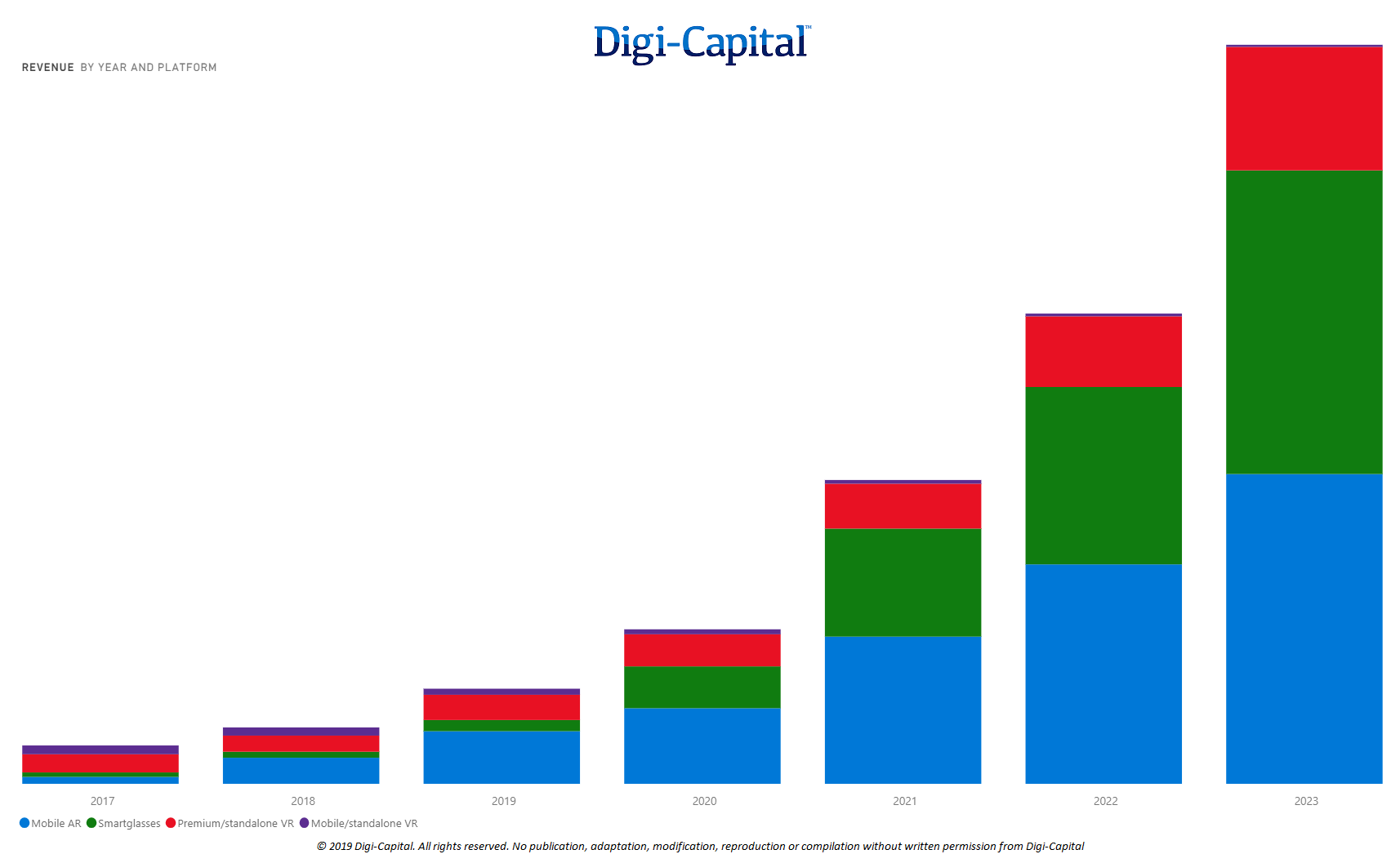

AR/VR platform revenue

Source: Digi-Capital AR/VR Analytics Platform

Mobile AR

While mobile AR revenue outperformed slightly last year, underlying data at the platform level has guided us to downgrade mobile AR’s installed base long term. Where Apple and Facebook control their platforms (ARKit, Spark AR), Google doesn’t — it had to rely on Android phone maker partnerships to grow ARCore configured devices from 100 million to 250 million last year.

That’s still a big number, but the growth curve it implies now means that our AR/VR Analytics Platform forecasts ARCore’s installed base trailing Apple/Facebook until 2021. So while ARKit and Spark AR growth paths remain on track with previous forecasts, a slower growth path for ARCore means there could be a total mobile AR market installed base just over two and a half billion globally by 2023. Again, still a big number, just not as big as originally anticipated.

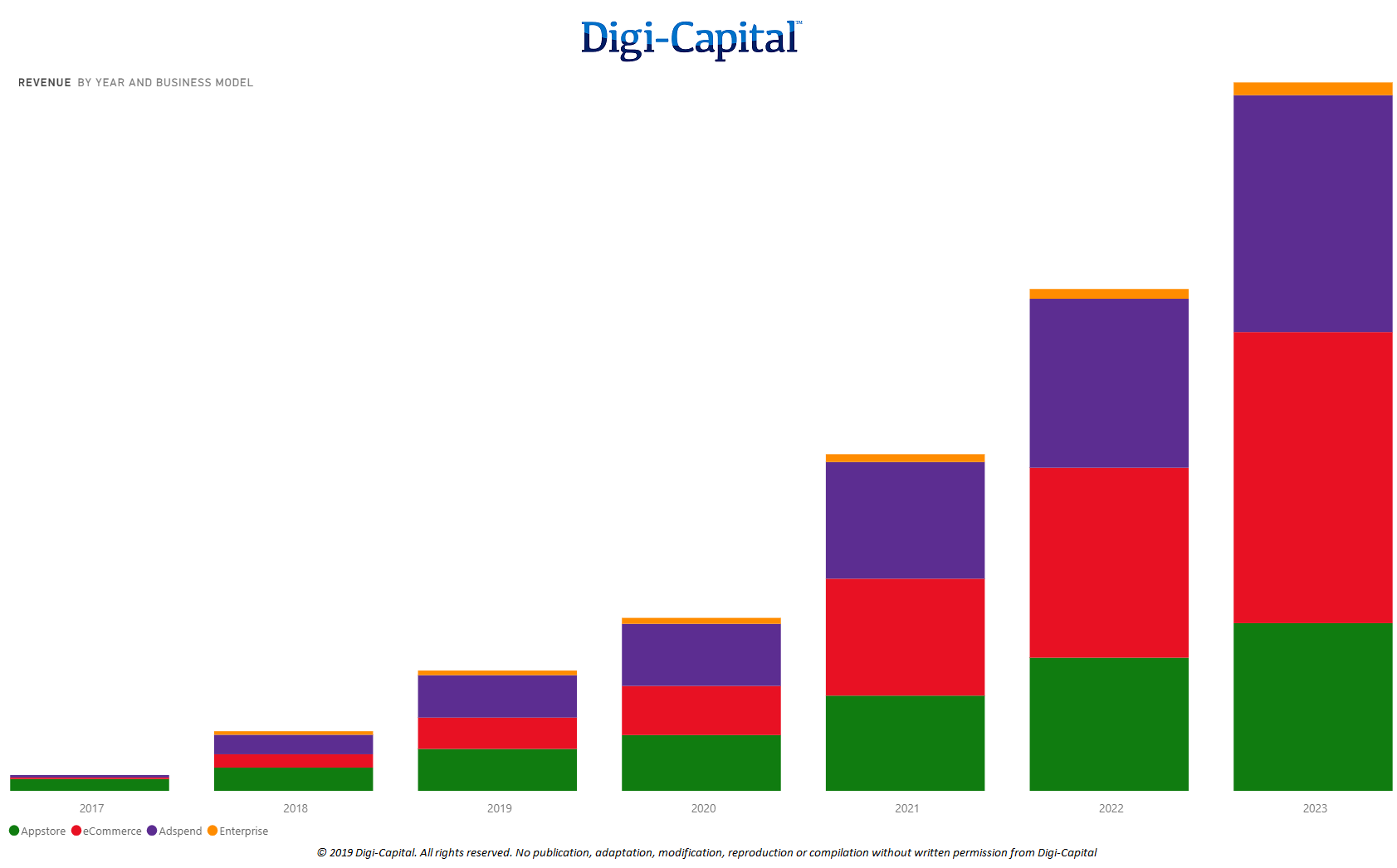

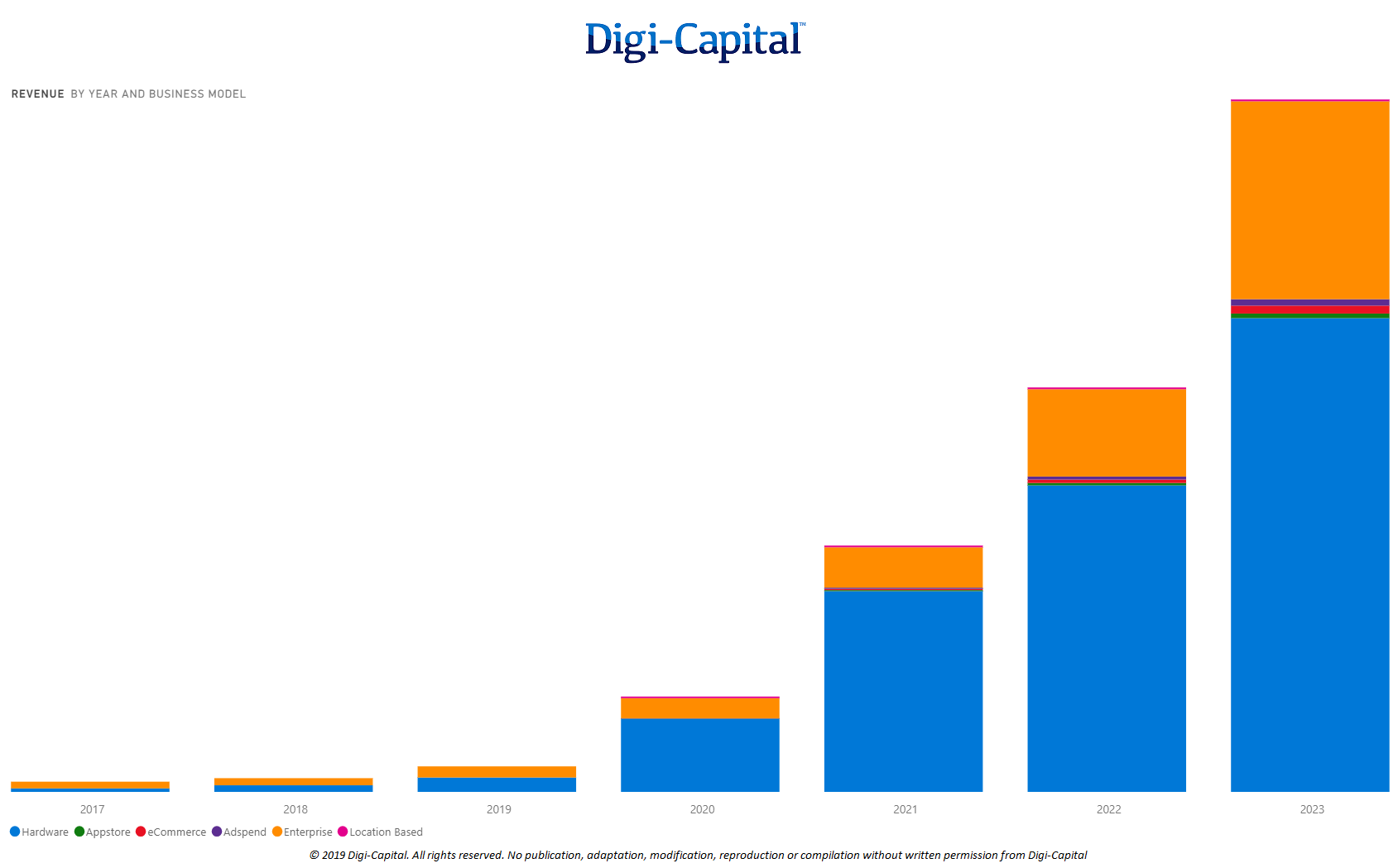

Mobile AR business model revenue

Source: Digi-Capital AR/VR Analytics Platform

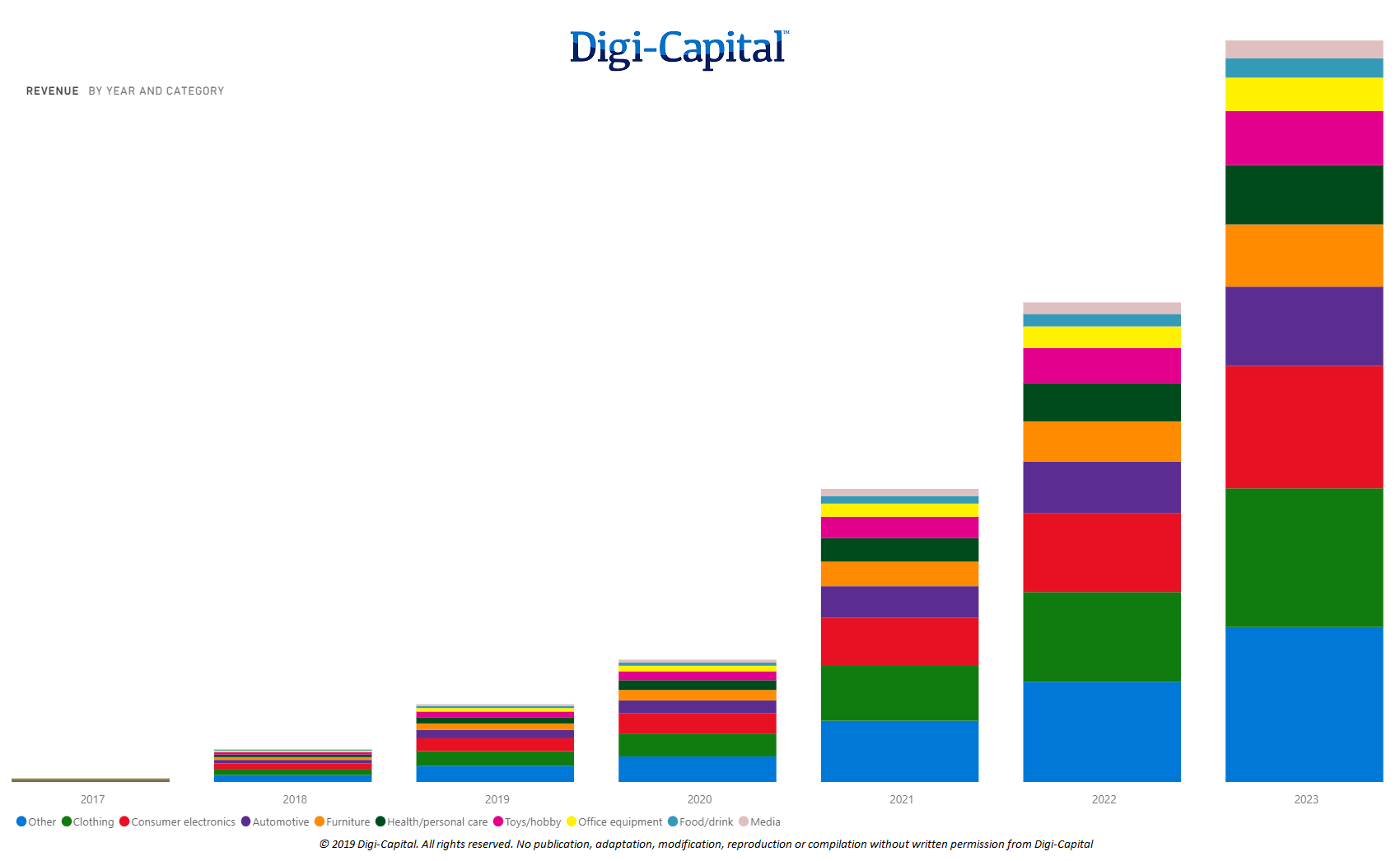

E-commerce across 10 major categories (from cars to clothing to toys) looks set to be mobile AR’s largest revenue stream, which together with ad spend across 11 major advertiser categories (from retail to CPG to travel) could deliver three quarters of mobile AR revenue long term.

AR e-commerce sales

Source: Digi-Capital AR/VR Analytics Platform

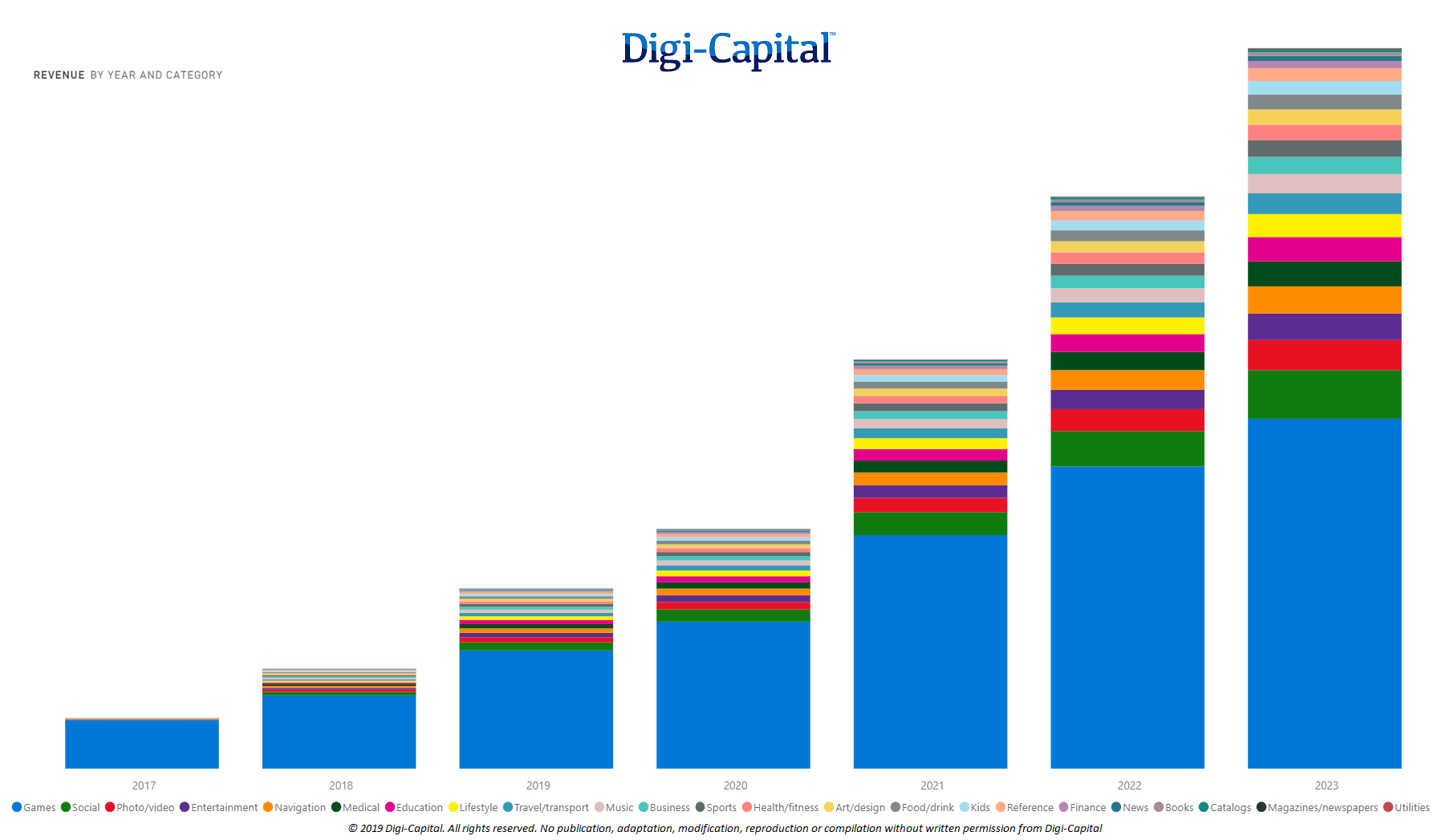

Mobile AR app store revenues (in-app-purchase/premium) remain dominated by games (primarily Pokémon GO) today, but mobile AR’s installed base and increasing adoption as a feature in mainstream apps could see non-games categories take more than half the mobile AR app store revenues by 2023. As with the overall mobile market, it could remain difficult for standalone mobile AR apps to rise to the top of app stores. Mobile AR growth could have more to do with mobile AR features in ubiquitous apps than new standalone apps.

Mobile AR app store categories revenue

Source: Digi-Capital AR/VR Analytics Platform

Smartglasses

Smartglasses have to deliver on five major challenges before they can become mass market consumer devices: (1) hero device (i.e. an Apple quality device, whether made by Apple or someone else), (2) all-day battery life, (3) mobile connectivity, (4) app ecosystem and (5) price. Together, these are non-trivial problems, and could see smartglasses remain mainly enterprise focused through the middle of 2020. Smartglasses device sales could stay in the hundreds of thousands of units globally this year.

Smartglasses business model revenue

Source: Digi-Capital AR/VR Analytics Platform

If Apple launches iPhone-tethered smartglasses in late 2020 (as we’ve forecast since 2016), the AR/VR market could finally see its inflection point. Nonetheless, long-term smartglasses revenues could remain dominated by hardware and enterprise (ex-hardware) revenues through 2023. The mass market for consumer smartglasses still looks a long way off, even with Apple’s entry.

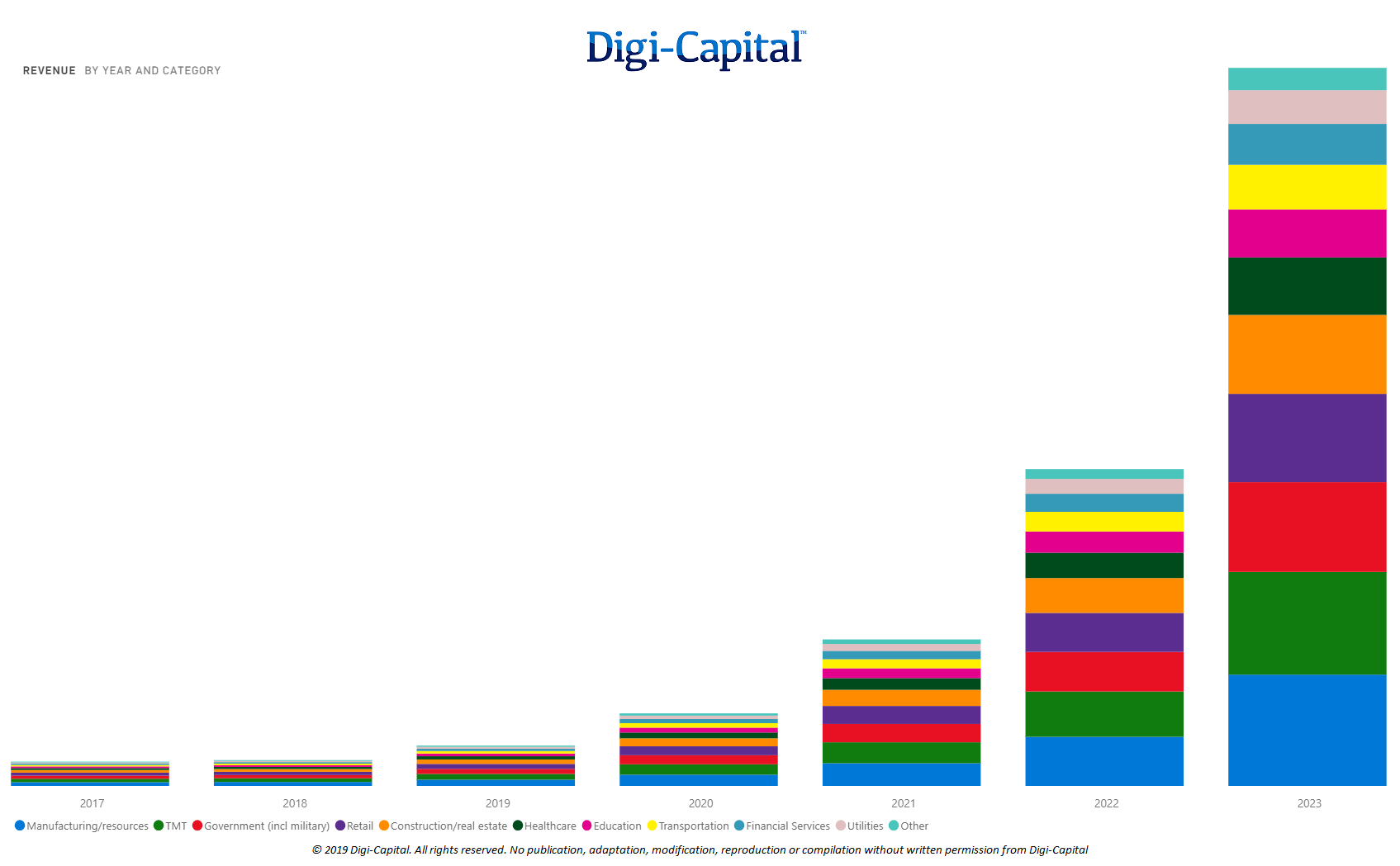

Smartglasses enterprise revenue

Source: Digi-Capital AR/VR Analytics Platform

Smartglasses enterprise pilot projects and full-scale rollouts have been symptomatic of an early-stage tech platform, but real-world productivity results are now being delivered with companies like Lockheed Martin reducing satellite building activities by more than 50 percent using HoloLens/Scope AR. When smartphone-tethered smartglasses reduce system costs and expand the range of applications, “bring your own device” could see smartglasses enterprise revenues kickstart an inflection point in 2021 across manufacturing/resources, TMT, government (including military), retail, construction/real estate, healthcare, education, transportation, financial services and utilities industries.

VR

VR could return to modest growth this year, and remain dominated by hardware and games revenues. The second generation of premium standalone VR headsets (not those launching this year) could become a catalyst in the 2020/2021 time frame. For this to happen, they will need to deliver greater performance and better content at lower prices. Hopefully by that time we could also see VR platform holders simplify their product ranges from their current platform fragmentation (taking a page out of Steve Jobs’ 1997 playbook).

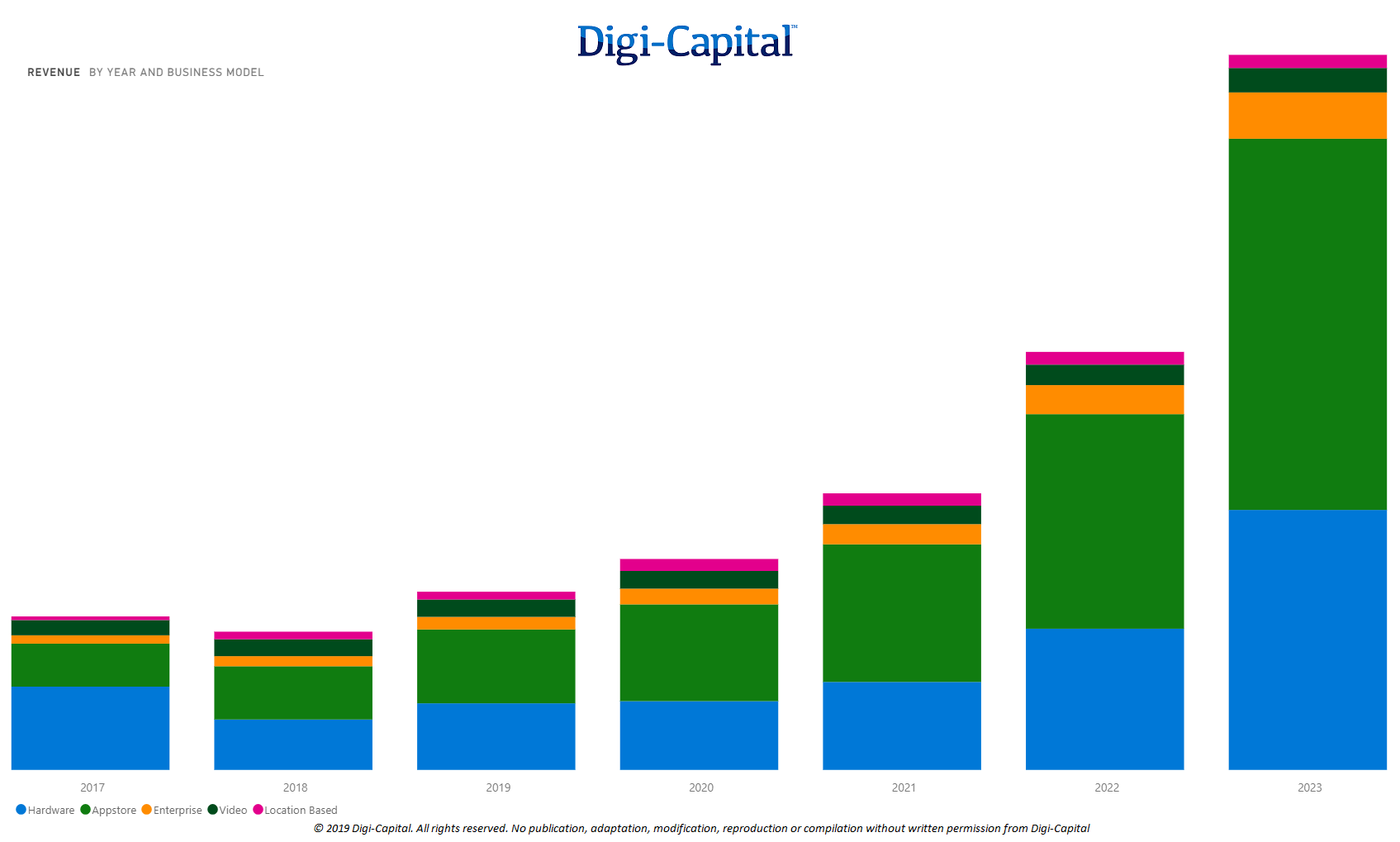

VR business model revenue

Source: Digi-Capital AR/VR Analytics Platform

VR revenue comes primarily from entertainment, and is driven by premium/standalone VR more than mobile/standalone VR due to installed bases and unit economics. Games software revenue could dominate long term, followed by hardware, enterprise (ex-hardware), video and location-based entertainment revenue streams. Due to VR platform holders’ gamer focus, they face the same challenges as Sony and Microsoft when they tried to diversify games console revenue streams beyond games (with mixed results).

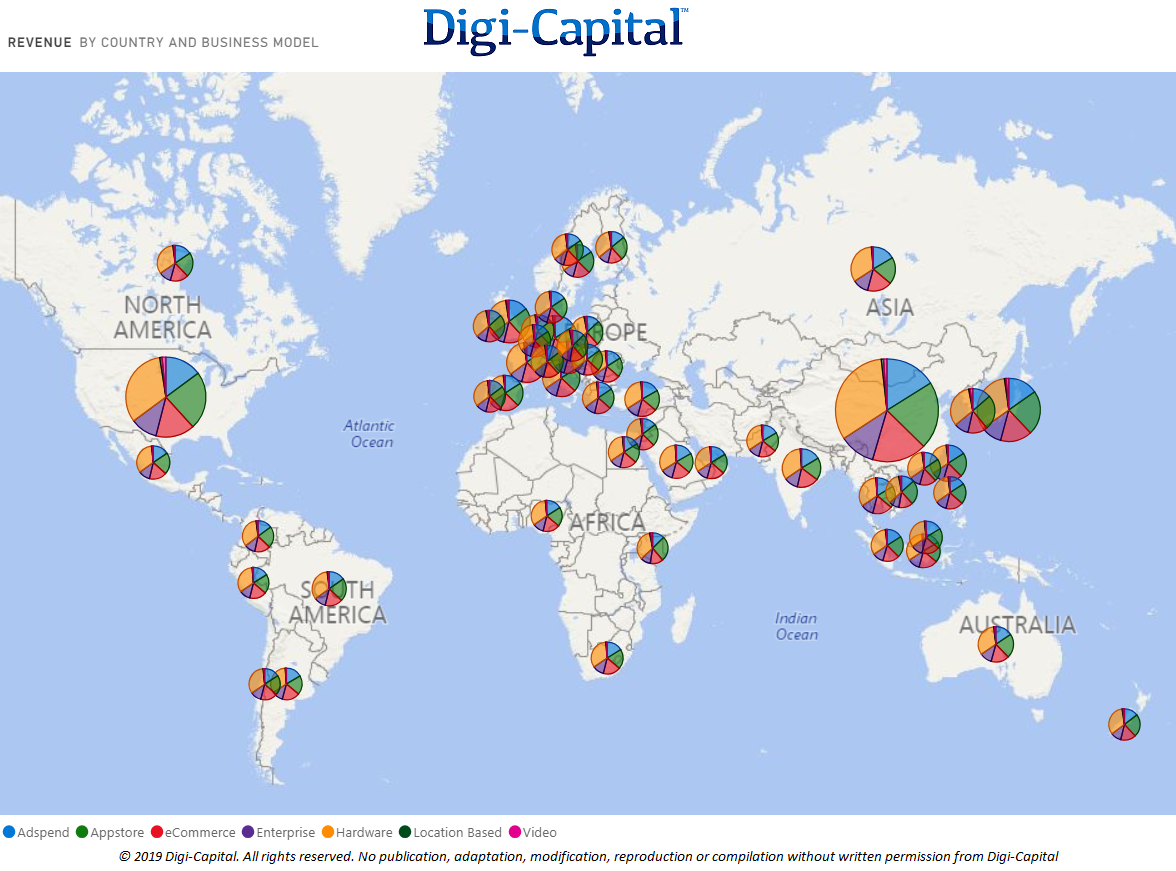

AR/VR countries revenue

Source: Digi-Capital AR/VR Analytics Platform

Asia is set to dominate AR/VR for the next five years, driving more revenue than North America and Europe combined by 2023. China’s commitment to the market is a standout, and it could remain the largest single market for AR/VR long term.

So what’s needed to go from AR/VR 1.0 to 2.0?

A lot of things might need to change to take us from AR/VR 1.0 to 2.0:

High friction to low friction: A large part of AR/VR 1.0 remains high friction in terms of installation, UX and UI. In many ways the market today looks like the MP3 player market before Steve Jobs launched the iPod (keep that analogy in mind). AR/VR 2.0’s lower friction is in the works, but what’s needed here are Apple smartglasses (whether they call them iGlasses or something else), the second generation of premium standalone VR (that comes after Oculus Quest and HTC Vive Focus) and mobile AR developers innovating beyond the lessons learned from Niantic, Houzz and others.

Experiences to use cases: There have been many “experiences” during AR/VR 1.0, with visually stunning apps not delivering meaningful UX. An AR/VR dragon or portal is impressive the first time you see it, but gets old pretty quickly. The next stage of AR/VR must deliver against critical use cases, with features in critical apps that we use all day, every day.

Standalone to features: The industry has largely focused on standalone apps to date, but major features in apps we use every day could see higher usage and prove more commercially successful. Navigation (Google Maps), e-commerce (Amazon, Walmart, Alibaba) and messaging (Facebook Spark AR, Snapchat Lens Studio) are beginning to show how this might happen.

Expensive to good value: Early AR/VR has ranged from $3,000 HoloLens to $200 Oculus Go to free mobile AR. But competing platforms often deliver more for less outside of specific use cases, particularly where we already own them, as with mobile. AR/VR 2.0 needs to become a great value because of what it delivers to users regardless of price point.

Point solutions to ecosystem: Many early AR/VR apps have been entertainment (games, video) or standalone point solutions to specific problems. As we’ve discussed before, AR/VR needs its own reality ecosystem to scale.

Low ROI to high ROI: For consumers, this means apps that give back more than just a “wow,” and for enterprises, applications that deliver real return on investment. This is beginning to happen in enterprise with companies like Lockheed Martin and Bell.

Pilots to production: Enterprise AR/VR 1.0 has seen many pilot projects, but relatively few full production rollouts. This is beginning to change, with companies like Walmart (with STRIVR) beginning to move into full production.

Inside baseball to brands: The AR/VR industry is still debating the merits of using AR, VR, MR, XR or spatial computing to describe itself, as well as spending a lot of time focused on internal plumbing across the stack. But consumers and enterprises outside of early adopters don’t care. They buy brands that deliver against critical use cases rather than just tech, which requires a clearer focus on users and how to market to them to succeed.

Fragmentation to dominance: AR/VR 1.0 remains fragmented across both hardware and software, despite its early stage and relatively small user bases. The industry now appears to have made up its mind on which platforms matter, so natural selection could thin the herd to a few dominant players in each part of the market.

Blue Sky to data driven: Many AR/VR 1.0 companies have been coy about their numbers, with independent data sources hard to come by in the early market. Developments like Digi-Capital’s AR/VR Analytics Platform have made it difficult to hide, with hard data/analytics now available to answer granular questions about roadmaps, country rollouts, investments, valuations and more.

VC-funded to cockroach/money making: Well-funded pioneers began to exit the market last year, with 2019 potentially seeing a major shakeout of companies that aren’t at least breaking even. The U.S. AR/VR investment market began to reverse its decline in Q4 2018 (even as Chinese investment accelerated), but making money and “cockroaching” burn rate could be more important than VC money in AR/VR 2.0.

Everyone else to Apple: If Apple launches smartphone-tethered smartglasses in late 2020, AR/VR 2.0 could have its “iPod moment,” where a major new form factor introduces the starting point for a long-term mass consumer market. It’s worth noting that this might not be the industry’s “iPhone moment,” as even with this catalyst we aren’t looking at a mass consumer market in the next five years.

Denial to acceptance: 2019 isn’t the “Year of AR/VR,” and Mark Zuckerberg’s “1 billion people in VR” might never happen. Mark’s come to terms with it, so hopefully a sense of cautious optimism could prevail during the next stage of the market.

What about AR/VR 3.0?

Even though we’re looking at a potential $80 billion to $90 billion AR/VR market by 2023, AR/VR 2.0 won’t be the finished article. That could take a lightweight pair of standalone smartglasses, capable of replacing your iPhone at the same price. There are formidable technical and content challenges to reach that vision of AR/VR 3.0, and there’s AR/VR 2.0 to navigate first.

It’s going to be an exciting time, and we can’t wait to see what comes next.

from TechCrunch https://tcrn.ch/2FyFByl

No comments: